One year ago, all 50 states and the District of Columbia announced a $141 million settlement with Intuit, the maker of TurboTax. The investigation, led by New York Attorney General Letitia James, centered on how the company had steered customers into paying for tax preparation even though they qualified for a free government program. The attorney general said the probe was sparked by ProPublica’s reporting in 2019.

About 4.4 million low-income Americans will receive payments under the agreement. On Thursday, James announced that the process of actually mailing checks to all those people will begin next week.

“TurboTax’s predatory and deceptive marketing cheated millions of low-income Americans who were trying to fulfill their legal duties to file their taxes,” she said. “Today we are righting that wrong and putting money back into the pockets of hardworking taxpayers who should have never paid to file their taxes.”

The payments range from $29 to $85, depending on how many years each eligible consumer used TurboTax. (A number of people cited in ProPublica’s articles said they had paid over $100 for what they had thought would be free services.) The agreement covered 2016 through 2018. Those eligible for payments will be contacted by email and will not need to file a claim.

Intuit did not admit wrongdoing in the settlement.

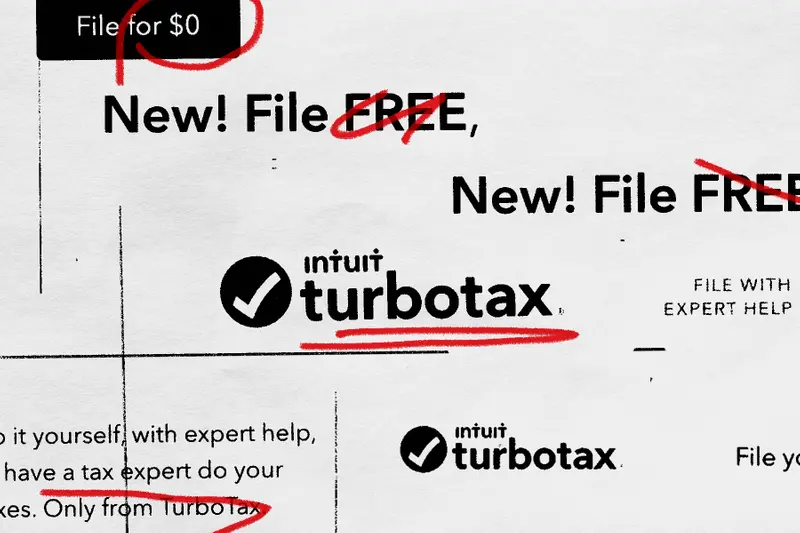

As ProPublica documented in story after story, TurboTax for years lured consumers with the promise of “free” tax filing and then deployed a range of tricks and traps to steer them to paying products.

Meanwhile, Intuit has lobbied for decades to prevent the government from developing a free tax filing system. One result of that fight, 20 years ago, was the IRS Free File program: In exchange for the IRS agreeing not to develop a free filing system, the tax prep industry agreed to offer something similar. On paper, the program allowed 70% of taxpayers to file for free. But only a tiny percentage of people ever used Free File — in part because Intuit, H&R Block and others actively sought to prevent taxpayers from finding out about it while pushing their own “free” products.

After ProPublica’s articles in 2019, the situation shifted. The IRS and the tax prep companies dropped the provision that prevented the IRS from making its own free filing system. H&R Block and TurboTax dropped out of the Free File program. And the IRS is actively studying how a public free filing program might work.

In addition to the investigation by the state attorneys general, the Federal Trade Commission also sued Intuit, claiming the company deceived consumers with its “free” marketing. Intuit defended the accuracy of its ads but said it voluntarily ceased broadcasting its “free, free, free” TV ads in a “spirit of cooperation.” That case is ongoing.