If you watch TV, you’ve likely been inundated with ads about tax prep services that promise to meet your every need or let you file for free.

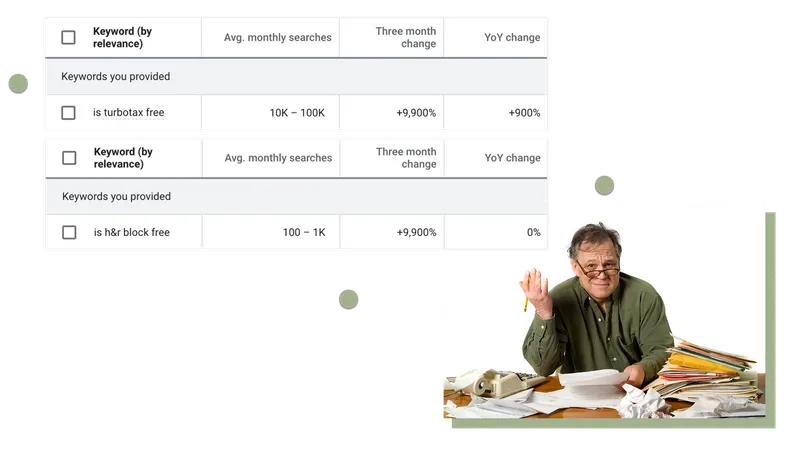

It’s the time of year when people open search engines and ask: “Is TurboTax free?”

ProPublica has been asking similar questions since 2013, when we first reported on how Intuit, TurboTax’s parent company, fought to keep the government from setting up a free, simple tax filing process. In the intervening years, our reporters have stayed on the story, uncovering the company’s sweeping history of lobbying and “dark pattern” customer tricks, which have helped it fend off a free government tax-filing option and create a multibillion-dollar software franchise.

Last year, we wrote a guide presenting several ways people could file their taxes for free. But this year a few things have changed: For one, TurboTax is no longer participating in the IRS Free File program, a public-private partnership that it helped construct. Under Free File, tax prep companies agreed to provide free online filing to tens of millions of lower-income taxpayers, and in exchange the government agreed not to offer its own free filing tools. In 2019 and earlier years, TurboTax and H&R Block together accounted for around two-thirds of all filings through the program, according to ProPublica’s analysis. But H&R Block left the program in 2020, and now, Intuit wrote in a blog post, it too is leaving “to focus on further innovating in ways not allowable under the current Free File guidelines.”

A spokesperson for Intuit said the company was “at all times clear and fair with its customers” and has upheld its obligations to the IRS under the Free File program.

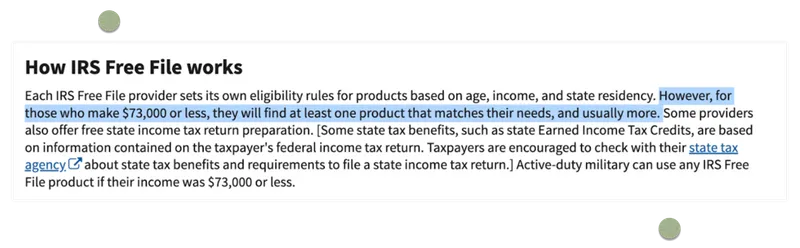

Despite the departure of the two major players, the IRS Free File program will still let you file your federal taxes for free if you make less than $73,000 a year. You can browse the list of the remaining providers yourself, or you can answer a couple questions and have the lookup tool connect you with the providers you are eligible to use.

Wait, in case you missed that: If you get nothing else from this story, please remember that you can file your federal taxes FOR FREE.

Still, TurboTax’s departure made me wonder: What are these amazing innovations it’s offering that aren’t “allowable” under IRS guidelines? Are they worth the cost of dealing with TurboTax?

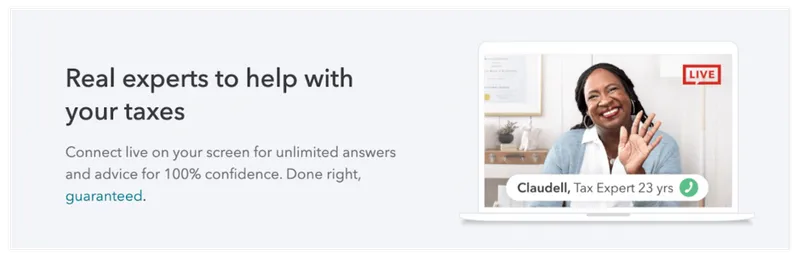

A TurboTax spokesperson said, “The Free File Program rules did not allow Intuit to provide all of the benefits we can deliver to help consumers with their complete financial health, not just in tax, but beyond.” Leaving the program would, for example, allow TurboTax to offer customers access to tax experts and other financial services, he said.

I decided to run a little test. Even though it has dropped out of the IRS Free File program, the company still offers its own “free” version and pours millions into marketing it. To see how TurboTax’s “free” version measured up, I went through the steps to file my taxes through TurboTax’s service as well as through an IRS Free File provider.

I’ve actually used both before — TurboTax on my first few years of income, and IRS providers starting in 2019, after I read reporting by ProPublica and commentary by the comedian Hasan Minhaj.

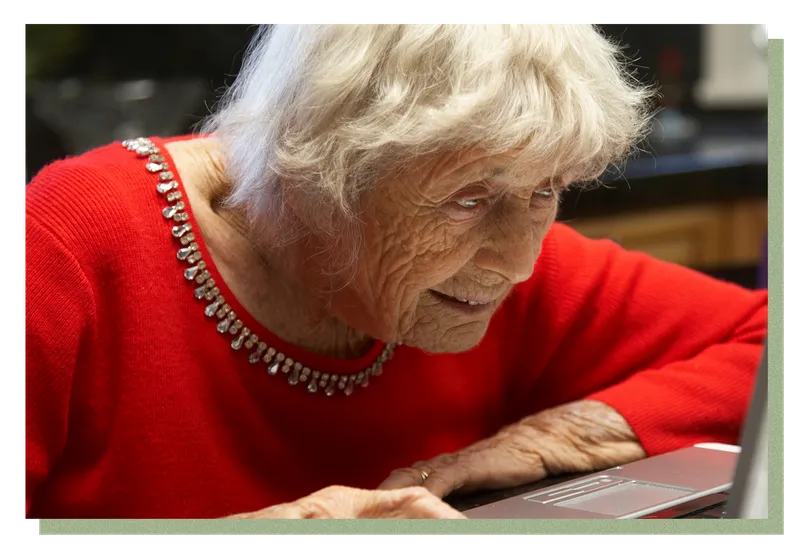

The IRS claims that 70% of Americans can file their taxes for free through Free File, but in reality, only about 1% of those who are eligible actually use the service. And we reported in 2019 that in recent years, the IRS had spent no money at all to advertise the program. On top of that, participating companies often set up roadblocks to genuinely free filing for the folks who do find the service.

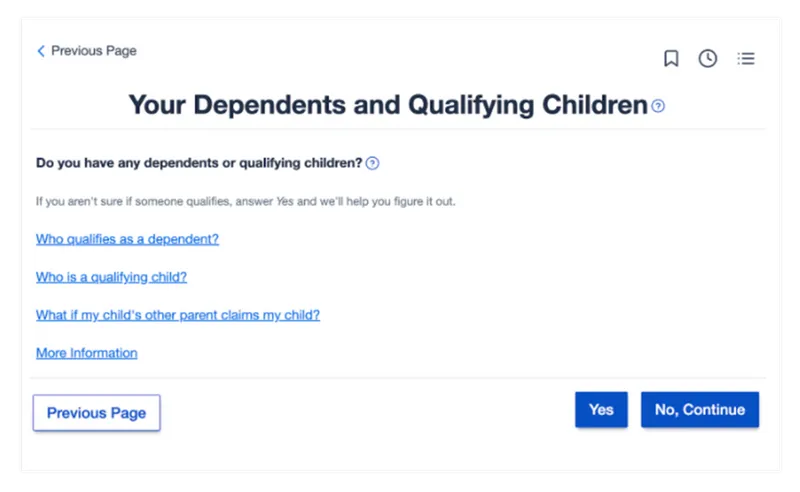

Free File only requires that the partner companies offer free federal returns, so it may be difficult or impossible to file your state taxes for free, depending on your income bracket. And while the state return is the most common source of a tacked-on charge, providers can also pitch loans, “audit defense” scans or even products that have nothing to do with taxes to Free File users.

Some companies are advertised as free on the IRS website, but then require taxpayers with certain tax documents, like 1099s, to pay for a much more expensive service.

The people who get 1099s often aren’t wealthy — recipients include the approximately 1 million people who drive for Uber, and women with care-taking responsibilities who take low-paid contract work to accommodate child or elder care schedules.

Finding providers that are both genuinely free and user-friendly adds another layer of difficulty. Several of the IRS providers allow you to upload photos of your tax forms to make the process easier, but some had state restrictions and others charged you to file a 1099, which I needed to do.

In fact, I had quite a few forms to file.

In 2021, I was:

A contract worker for a Southern California nonprofit.

A full-time fellow for ProPublica in New York City.

A part-time crew member at Trader Joe’s (Store 20 forever).

A freelance writer for a local investigative paper.

And a very sporadic email newsletter writer for my hometown running store in Virginia.

That adds up to three W2s and two 1099s across three states, and less than $50,000 in income, which is just the kind of low-paying tax mess that TurboTax’s innovative services should be able to help with,right?

Let’s dive in.

The TurboTax Saga

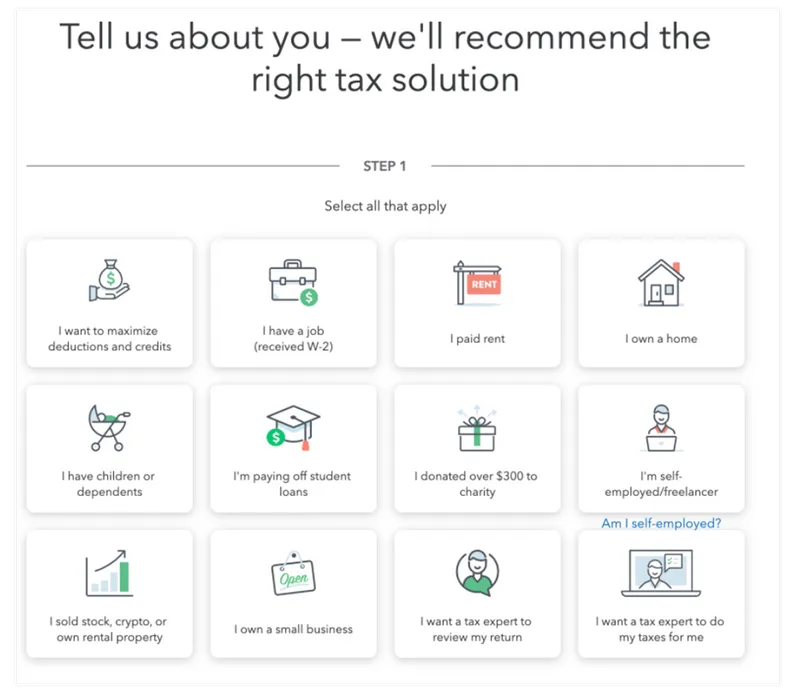

Below is the screen TurboTax shows you while trying to figure out if its free version is “right for you.”

These are the buttons that steer you away from the free version of TurboTax:

- “I want to maximize deductions and credits.”

- “I donated over $300 to charity.”

- “I’m self-employed/freelancer.”

- “I sold stock, crypto, or own rental properties.”

- “I own a small business.”

- “I own a home.”

Intuit’s spokesperson told me that “Pressing buttons has no effect on whether or not a user qualifies or disqualifies from using TurboTax Free Edition. Pressing buttons generates a recommendation to use a particular TurboTax product, but the consumer is free to use whatever product they wish.”

The cheapest program I can file under as an ex-freelancer was TurboTax Deluxe, for $39.

So I start there and wait to see if TurboTax’s excellent features will make me that money back in refunds.

(Spoiler: They don’t.)

The bummer is, I love using TurboTax. Not because it saves me money, but because clicking the big, eye-catching buttons gives me a false sense of control and a hit of dopamine.

Check! I’m achieving!

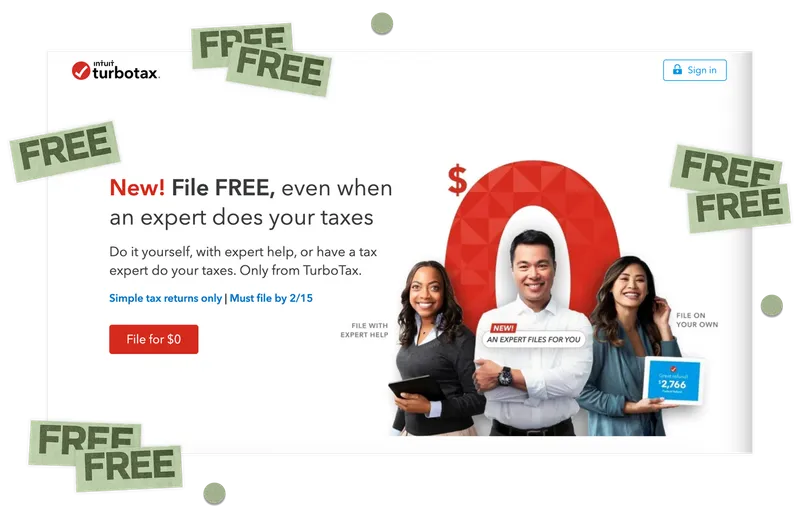

And I think Intuit knows what appeals to me about its software, because back when it offered a genuinely free service through the IRS, that website was confusing, slow and ugly. There were no pretty buttons. And almost no one could find it, because Intuit hid it from Google and other search engines. (It stopped hiding the page from search engines after ProPublica reported on the practice.)

Anway, back to my tax filing.

After a soothing video in which I am assured that TurboTax can handle the complexities of my tax situation, the site asks for permission to access my tax returns “for purposes other than the preparation and filing” of my tax return. If I wasn’t really paying attention (which would be understandable; taxes are mind-numbing), it would be easy to assume these permissions were necessary to file my taxes and not a ploy to give TurboTax additional access to my information. I decline.

An Intuit spokesperson told us, “The consent you referenced allows us to surface offers for other Intuit products or services, or those of third parties that would be relevant for our customers,” but “Intuit does not use or share tax information anywhere outside of the tax prep process — even with other Intuit products — unless a customer gives express consent.”

Next it tries to upsell me TurboTax MAX: Defend and Restore, which offers insurance against identity theft for another $49. I skip that too.

I’m five minutes into this process, and I’ve spent half my time rejecting TurboTax’s attempts to collect additional money or information.

I know that reading about me doing my taxes might seem even more boring than doing your own, but bear with me as I describe a few notable events from my TurboTax journey because I think they’ll help us understand more about how the tax prep industry works.

Here are some features that initially appealed to me:

- Free live online chats with tax specialists.

- The ability to link to my eTrade account just by logging in, saving me the trouble of entering information about stocks and dividends manually.

- Expandable explainers that answer questions like, “Why am I taking the standard deduction?” and, “How do I know if I got my 2021 stimulus check?”

- The ability to automatically pull my 2021 W2s for the employers that I worked for in previous years I filed with TurboTax.

- The option to upload a photo of my W2 from the places where I started work during 2021, like ProPublica, instead of manually entering details from each individual box. There were occasional clarifying questions (“Box 20 seems to be blank — can you confirm this?”), but they were easy to deal with.

And all the while, TurboTax is doing the software equivalent of gently patting my head.

After I submit each W2, I’m shown an encouraging screen that tells me I’m on track for my biggest refund yet! I feel inches from those promised dollars.

Once all my W2 information has been submitted, little animated papers file themselves under the heading “Sit back while we fill in your New York return.” It gives me the impression TurboTax is working hard for me.

In reality, this is the digital equivalent of TurboTax twiddling its thumbs.

Former staffers told reporter Justin Elliott that Intuit’s designers added these animated delays between screens to both reinforce and ease consumers’ “fear, uncertainty and doubt.” TurboTax encourages this subconscious sense I’ve had the whole time that taxes are a scary dark maze that I can only navigate if I let the software lead me by the hand.

In a statement, an Intuit spokesperson said, “The process of completing a tax return often has at least some level of stress and anxiety associated with it. … To offset these feelings, we use a variety of design elements — content, animation, movement, etc. — to ensure our customers’ peace of mind.”

The cute face of this software creates a feeling of trust that I can’t totally shake, even though I’m going through all this for a ProPublica piece, which is about the least trusting way you can undertake any activity.

This feeling fades slightly when I move on to inputting my freelance (1099) income.

Because taxes weren’t withheld from that income when I was paid, all taxes are instead calculated and owed when I file, a fact I always forget and never enjoy remembering.

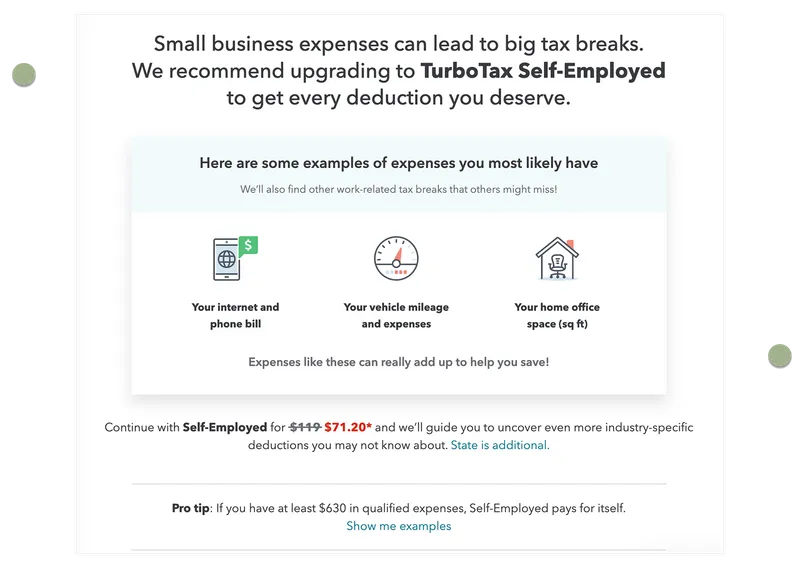

TurboTax tells me I can reduce my self-employment tax by entering self-employment expenses, like cellphone service or gas mileage.

On the next screen, TurboTax offers me a list of possible applicable expenses I could deduct, and I feel a rush of affection for the site. This could be the moment TurboTax finally starts paying for itself.

Ah, but wait.

It’s another upsell — this time for TurboTax Self-Employed.

The site tells me that if I have at least $630 in expenses to report, TurboTax Self-Employed will pay for itself. At first this seems like helpful information. Then it strikes me that if my qualifying expenses fail to clear that threshold, or just barely clear it, then by taking the offer I would have happily paid TurboTax $70 to “save” $70, and essentially walked away empty-handed.

I check: “I don’t have expenses,” even though I do. I just don’t have enough that I can afford to pay for the pleasure of reporting them.

I go through the same song and dance for a second 1099, and then we hit upsell number three.

Remember that offer of “NO COST” chats with tax specialists that endeared me to this service?

Well, the tax experts are back!

And ol’ Intuit is once again trying to sell me something it claims to offer for free, this time in the form of TurboTax Live Deluxe. Intuit said that while product experts are available to connect with tax filers to answer questions about the filings themselves, Live connects customers with tax experts that specialize in specific filing statuses (such as someone who knows a lot about freelancers).

Shortly after declining the live services, I get a question about how my experience has been so far.

Me:

When we get to the state tax section, I learn that TurboTax will charge me an additional fee for each state I need to file in.

That adds up to a $156 bill: $39 for each of the states I need to file in — California, New York and Virginia — plus $39 for TurboTax Deluxe.

According to TurboTax’s website, “Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice.” You can find this information if you click to expand a box called “*Important offer details and disclosures” at the very bottom of the page.

And before I can pay, it tries to sell me TurboTax MAX one last time.

Overall, a “not so good” experience.

Free File Through the IRS

After looking through four or five providers, I ultimately decide to use FreeTaxUSA to test the process of filing through an IRS Free File provider. I’ve used it in the past, and while the service requires users to input their W2 and 1099 information by hand, it claims to offer free state tax filing and doesn’t charge for 1099s.

The questions don’t come with as many cool graphics, but they’re still clear and easy to answer.

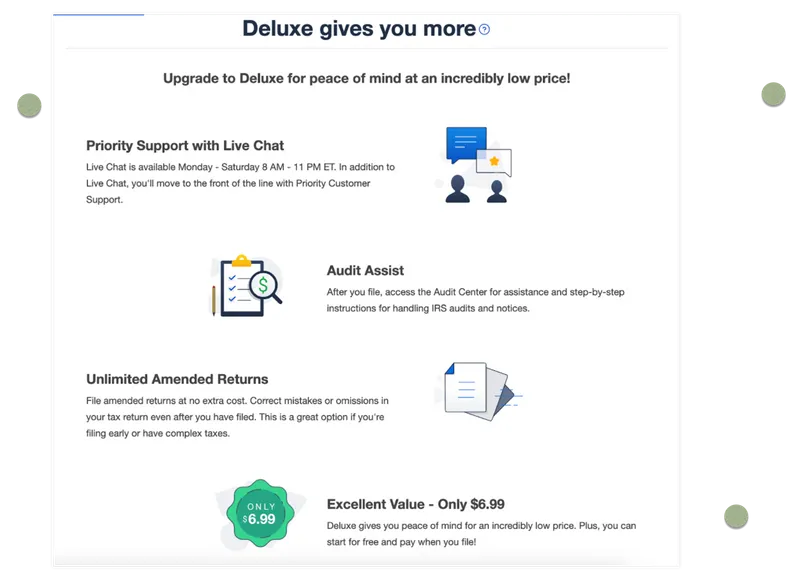

Like TurboTax, I’m upsold right out of the gate, but unlike TurboTax, the upsell is not mandatory just because I did freelance work, and the upgrade they’re offering is relatively inexpensive — FreeTaxUSA Deluxe is $6.99. The offer also only appears once, rather than four times, during the process.

FreeTaxUSA also allowed me to deduct my freelance expenses for no extra cost, which helped reduce my tax bill.

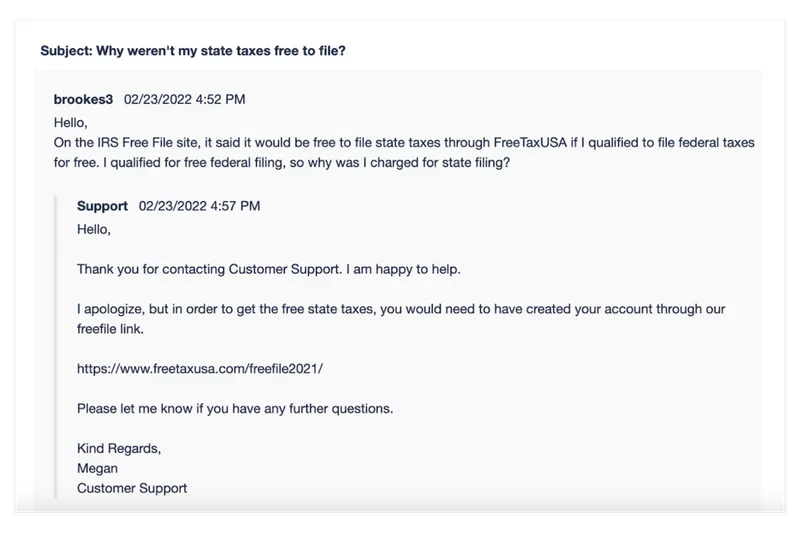

In the end, FreeTaxUSA asked me for $15 for each of the states I filed in — my federal return was, as advertised, free — for a total of $45. When I reached out to FreeTaxUSA support to ask why I didn’t receive the free state tax filing I was promised, they told me that in order to file for free I needed to create an account through their Free File link.

I had entered the FreeTaxUSA website via the IRS’ Free File link, but I struggled to log in to my old account that way. After cycling through this twice, I tried to see if I would have better luck restarting from the site’s homepage.

I did, but in doing so, I apparently lost that golden /freefile2021/ in my url.

At that point, I had been doing taxes for about two days straight. I got fed up and just paid, which is about the most everyman American taxpayer experience I could have had.

As a taxpayer and consumer, you have the right to know your options, particularly when you could be spending less money. But the big takeaway is not necessarily that one tax filing software is better or more honest than another. It’s not even that you should contact customer support before you pay (though I really should have).

The takeaway, at least for me, is that filing your taxes for “free” online is confusing and soul-sucking by design.

So take a deep breath, release a guttural scream, and don’t let some fun buttons lure you into paying more than you need to.

To paraphrase TurboTax: