Update, June 29, 2021: Missouri Gov. Mike Parson on Tuesday signed into law a measure to add consumer protections and oversight to programs that make high-interest “clean energy” loans in the state. Both Missouri legislative houses voted overwhelmingly last month to support the bill.

Diana Thomas needed a new furnace and four small basement windows for her two-story home on the east side of Kansas City. But she had little cash and bad credit.

In late 2016, a contractor told her about a loan program that required no money down and would let her pay off the balance over time as part of her annual property tax bill. Her first payment wouldn’t be due until the end of the following year.

Thomas, 53, knew she was in trouble when she got her 2017 tax bill. With the loan payment, her taxes had soared from $247 to $1,465. “I was like, ‘Oh my God, what have I done?’” she said.

To pay off her loan of $10,792, including fees, Thomas agreed to 15 years of payments at an annual percentage rate of 10%, for a total of $18,200. That’s more than the value of her home — $16,226, according to the county’s appraisal — when she took the loan.

Since then, Thomas has missed four years of tax payments. Jackson County, where she lives, has placed a judgment against her and, if she cannot come up with three years of taxes, will sell the house in August at a public auction, taking the proceeds to settle the debt and leaving her with nothing.

Thomas is one of about 3,000 Missouri homeowners who have borrowed money through a program known as Property Assessed Clean Energy, which was touted by then-Vice President Joe Biden in 2009 as a way to help lift the country out of the Great Recession while lowering consumers’ utility bills and fighting climate change. Through the program, local governments could borrow money at low rates and make it available to borrowers for energy-saving home improvements, allowing them to pay it back in their property taxes.

But under the management of private companies, PACE programs in Missouri have charged high interest rates over terms of up to 20 years, using the government’s taxing power to collect loan payments through tax bills and enforce debts through liens. By marketing their programs to people who need urgent repairs but have few options for credit, they have disproportionately burdened some of the state’s most vulnerable homeowners, a ProPublica investigation has found.

More than 100 homes with PACE loans in metropolitan Kansas City and St. Louis are at risk of being sold at public auctions after their owners fell at least two years behind on payments, according to a ProPublica analysis. Of those homes, at least 29 are slated for sale at auction this year.

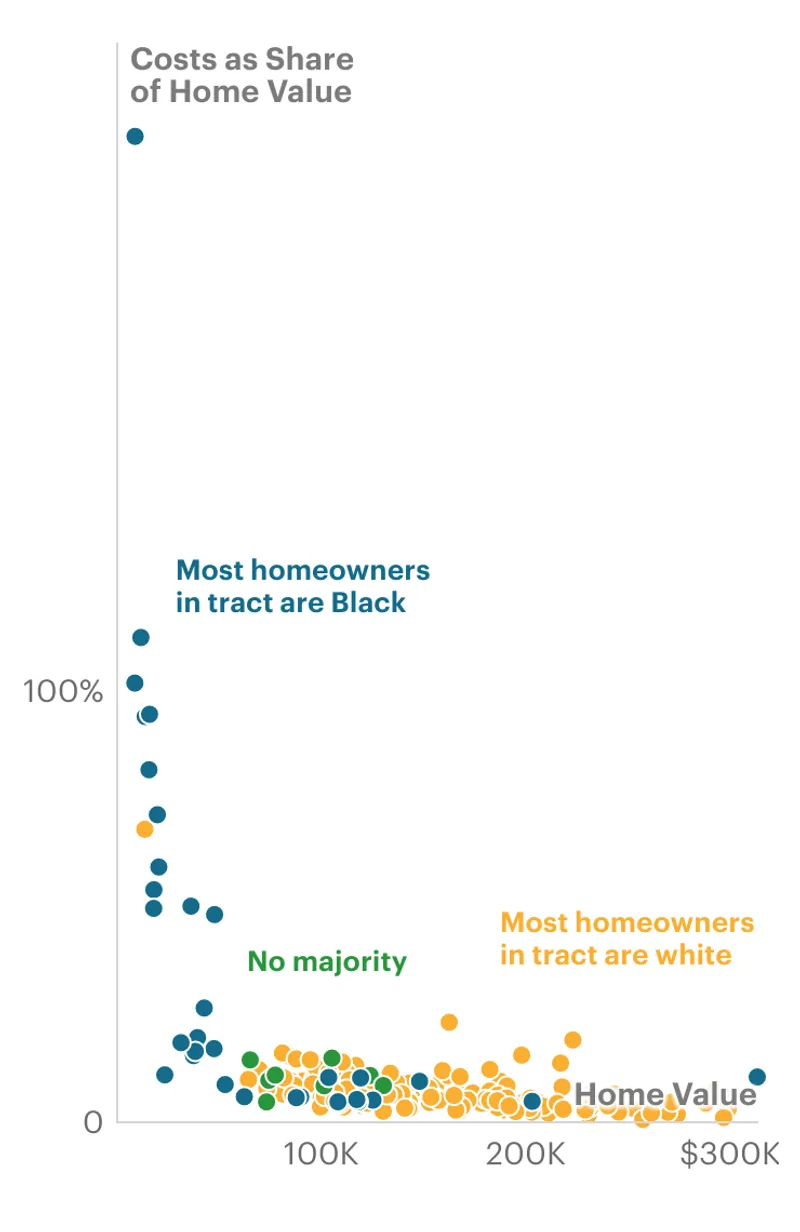

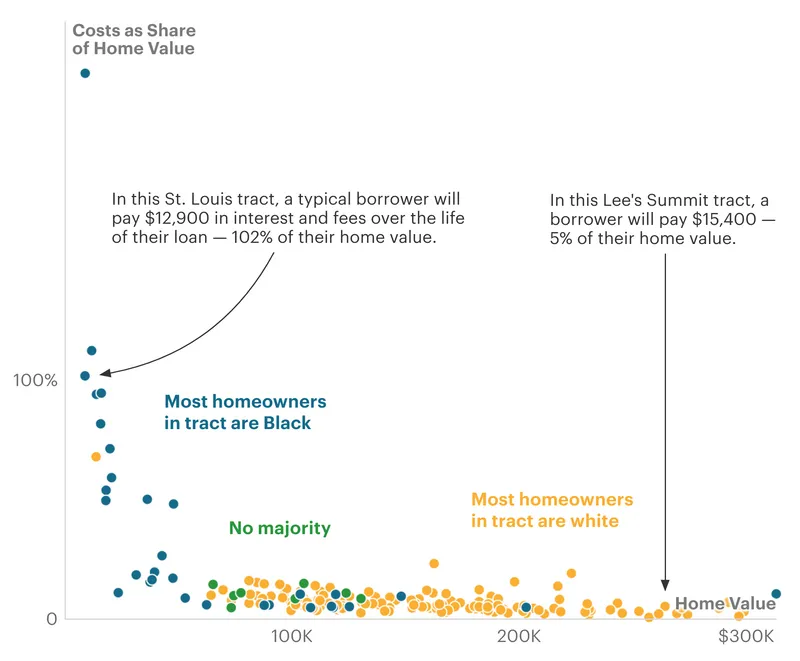

The analysis, which examined about 2,700 loans that were recorded in five counties with the state’s most active PACE programs, found that the loans have put a disproportionate burden on borrowers in predominantly Black neighborhoods. In those neighborhoods, 28% of borrowers are at least one year behind in repaying their PACE loans compared with 4% in mostly white areas. They’re also paying a larger share of their home value toward interest and fees — sometimes more than county appraisers say their homes are worth.

What’s more, the program has operated with little accountability. State law requires that PACE loans go only to people who can afford them and who will reap energy savings at least equal to the costs of the improvement. Yet local government officials tasked with overseeing the program said that they defer to private lenders to determine if those requirements are met, and are unaware of high delinquency rates.

And while the law authorizes PACE programs to do audits to ensure that borrowers save money on their energy costs, they are not required. Officials from PACE programs in the state’s two biggest metropolitan areas said audits are not typically done.

PACE officials and its lenders said that the program provides much-needed financing for home upgrades, particularly in predominantly Black neighborhoods where traditional lenders typically don’t do much business. They said their interest rates tend to be lower than those of some credit cards and of payday lenders, and that most borrowers make their payments.

The most prominent PACE lender in the St. Louis market, the Ygrene Energy Fund, said it has beefed up its standards by making sure borrowers paid previous property taxes on time and by using more conservative property valuations to underwrite loans. It said it has also reduced its delinquency rates since the program began making residential loans.

PACE was “designed to give affordable access to financing for critical property upgrades to those who may find it harder to get other types of financing,” the company said in a statement. “Given our work to date, we are delivering on the program’s mission.”

Jim Holtzman, the chair of the board that oversees Ygrene’s lending in St. Louis County, said the board depends on lenders to make sound loans and gives them wide latitude to operate. He said PACE is meeting its goal of providing financing for home improvements that help the environment.

“It’s like taking 400,000 cars off the street,” Holtzman said. “It’s just a great program for county homeowners.”

David Pickerill, executive director for the Missouri Clean Energy District, the leading PACE program in the Kansas City area, said its loans are crucial for homeowners who need to purchase a new furnace or air conditioning system during an emergency but do not have the cash on hand. It is, he said, “primarily a way to unleash unencumbered equity in a home to pay for energy conservation and renewable energy products.”

Tom Sadowski, president of the MCED board, said its PACE program has improved since it replaced its lender. That company, Renovate America, filed for bankruptcy protection last year after several lawsuits against it in California, site of the country’s first PACE program, which served as the model for Missouri.

Since 2016, PACE has expanded its residential loan program to some two dozen Missouri counties and the city of St. Louis, in spite of a backlash against the industry in California and in Florida, the only other states with large residential PACE programs. In Florida, the program is under investigation by the state attorney general. Ohio has just started to offer PACE to homeowners.

Missouri lawmakers are considering reforms, including a bill in the legislature that would require PACE’s residential loan programs to be examined by the state finance division at least every other year and that would establish penalties for violating the law. The legislation has passed out of the House and is under consideration in the Senate.

On Tuesday, Jackson County Executive Frank White Jr. vetoed a bill that would allow a second PACE program to operate there, saying in a statement he was troubled by ProPublica’s finding of “significant differences between how the program is impacting majority white and majority black areas” of the county.

That’s cold comfort for Thomas, who said she is looking for a lawyer to help her save her home. “I can’t just let them have my house,” she said. “They just can’t take my stuff from me like that.”

Desperate people taking on debt they can’t afford and putting their homes at risk was not what the originator of Missouri’s PACE law intended when she pushed lawmakers to enact the program in 2010.

Rosalind Williams, then the planning and development director in the St. Louis suburb of Ferguson, envisioned PACE as an affordable way to help homeowners restore property value lost in the Great Recession. She and other early supporters of PACE believed local governments would control the program.

But even before legislators passed the measure, entrepreneurs were trying to build businesses around it. Today, much of Missouri’s residential PACE market is run by competing groups of executives in charge of the two institutions that established control over the market early on: MCED and Ygrene.

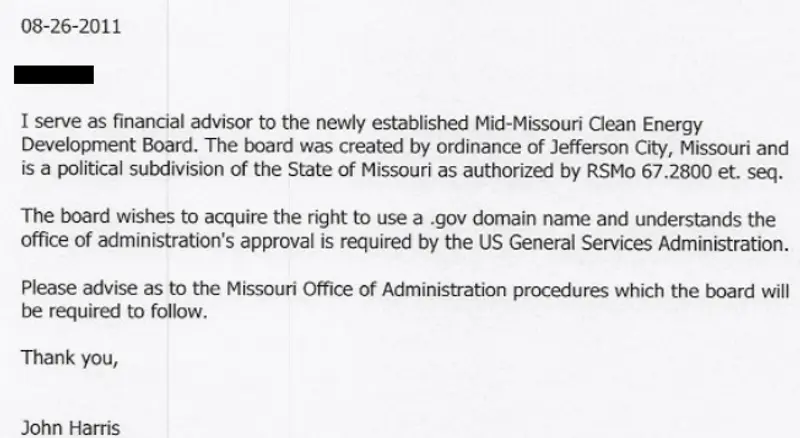

MCED was the state’s first PACE district, a special governmental unit empowered by state law to sell bonds and file tax liens. Pickerill and John Harris, who both have a background in investment banking, persuaded officials in Jefferson City to create it in 2011. Then Harris got the state to give MCED a dot-gov internet domain name and email addresses. Today, Sadowski is the MCED board’s president, Pickerill the district’s executive director and Harris the finance director.

With Pickerill and Harris in control, MCED’s board then awarded a no-bid contract to run the district to a company the pair owned. That company, in turn, hired other companies to make the loans.

Pickerill and Harris said they do not take salaries from MCED. Under their company’s contracts with the district and lenders, they have collected a percentage of every loan, which they estimated was about $300,000 in total. Through their company, MCED has issued at least $31 million in residential loans since 2016, ProPublica found. The company does not report its revenue to any public body in Missouri.

Pickerill and Harris said they qualified for a government domain name because “we are a political subdivision.”

“We laid the groundwork,” Pickerill said in an interview. “We got all the legal work done. We went out and recruited the municipal members. We put five years of work into this thing to get it going, all without compensation. And so, for that work, we feel like we’re entitled to some recovery of our costs and time.”

As MCED expanded to Jackson County, which includes most of Kansas City, and St. Charles County, in the far western suburbs of St. Louis, another pair of businessmen, Tom Appelbaum and Byron DeLear, started their own PACE company. That company eventually became dominant in the city of St. Louis and St. Louis County, which abuts the city.

Appelbaum and DeLear sold their company in 2017 to Ygrene Energy Fund. DeLear is now Ygrene’s managing director for the Midwest. Appelbaum is a lawyer for St. Louis County.

Today, MCED and Ygrene compete for market share across the state. In St. Louis County, where MCED's reach has been limited, it has lobbied county legislators to allow it to expand. Ygrene, meanwhile, has moved into MCED’s stronghold in St. Charles County and is trying to enter the Kansas City region.

In an advisory ruling in February, the Missouri Ethics Commission said PACE districts must follow the same rules as other public bodies that hire contractors: They must solicit competitive bids and the lowest bid must be accepted. District officers can’t get paid by contractors they hired.

The commission has never ruled specifically on MCED’s relationship with Pickerill and Harris’ company, and the pair said they were unaware of the commission’s ruling. They said their dual roles as both directors of the district and owners of its primary contractor were completely appropriate and said it wasn’t necessary to put the work out for bid.

“That’s how it works,” Pickerill said. “If you’re on the board of an organization, and you have a group you hire that’s been running it up to your satisfaction, are you really going to put it out for bid?”

Five years after lenders began making residential PACE loans in Missouri, neither of the legislative sponsors is still in office. House sponsor Jason Holsman, a Democrat now on the state’s Public Service Commission, declined comment. The Senate sponsor, Joan Bray, a Democrat, said she didn’t anticipate the problems that have emerged. She said she initially hoped PACE loans would help borrowers make affordable energy-saving home improvements, and that regulators would provide meaningful oversight of the program.

“I didn’t envision this as being an opportunity for a private business to charge interest rates that would put people in a financial bind,” Bray, who is retired, said in an interview.

For many borrowers saddled with PACE debts they couldn’t afford, the program seemed to offer a lifeline in an emergency. When the temperature dropped to near zero in the final days of 2017, and her furnace struggled to heat her 1,100-square-foot home in the St. Louis neighborhood of Walnut Park East, Joyce Piffins had few options. She called a contractor, who told her she could finance a new heating and cooling system through a bank loan if she had good credit. If not, the contractor said, she could use the city’s PACE provider, Ygrene. A home health aide earning $11.50 per hour, Piffins had poor credit and past bankruptcies. She went with PACE.

The contractor priced the project at $11,491. Piffins, 57, agreed to pay $1,658 a year for 15 years at an APR of 12%. By the time she pays off the loan, she will have paid $24,870, including $13,379 in interest and fees. That’s considerably more than the $8,421 the city appraiser said her home was worth when she took out the loan.

Her extremely low home value was a big reason she had to turn to PACE: Few banks would have been willing to lend to her, as even basic repairs would consume a significant portion of her equity. That lack of access to credit, common in Black neighborhoods north of Delmar Boulevard in St. Louis, is partly what drew city policymakers to PACE. Otis Williams, who leads the city’s economic development agency and is secretary of its PACE board, said the program helps “get things done in a marketplace where investors are shy to invest.”

Though Piffins now can heat her home, she might lose it.

After making her first tax payment, she has fallen two years behind. If she misses a third annual payment, the city of St. Louis can list her property for sale at auction. St. Louis County and Jackson County use the same three-year cutoff, while St. Charles County can list tax-delinquent property for sale after two years.

“I didn’t feel like I had a choice,” Piffins said. “I didn’t have money right then to pay for a new furnace, and it was cold.”

PACE lenders tout their product as fair because they charge similar interest rates and fees to almost every borrower — typically around 10% APR, according to ProPublica’s analysis. In fact, that consistency places a heavy burden on neighborhoods with low property values. Because of long-standing residential segregation, those at-risk borrowers are overwhelmingly Black.

Missouri’s PACE Loans Have Burdened Some Black Neighborhoods

Interest and fees pile up for borrowers in segregated communities with low home values.

Ygrene challenged ProPublica’s use of local government appraisals to measure the cost burden of its loans. The company relies on a private appraiser, whose property valuations tend to be higher than government valuations. Ygrene would not provide the data it used when underwriting Piffins’ loan, but said it will not lend more than 15% of a property’s fair market value, suggesting it had her home appraised at almost $60,000 — a value even Piffins believes is too high. MCED’s standard is 20% of fair market value.

Shawn Ordway, deputy assessor for the city of St. Louis, said that his office uses comparable neighborhood sales to appraise homes and is usually accurate within 10% of market value. Low values for some properties in St. Louis are based on low sales prices for other similar homes nearby, he said.

The assessor for St. Louis County, Jake Zimmerman, acknowledged that government valuations are occasionally wrong, but he questioned how a private company could appraise homes at many times their estimated value.

“That person is either smoking something, hiding something or lying about something,” he said.

Whether or not Piffins’ low home value reflects how much she could sell it for, she is still stuck with a loan she can’t afford, which she signed only because she lacked other options. Andre Perry, who studies racial inequality in home values at the nonprofit Brookings Institution, said that’s not the sign of a good program.

“If that product is going to put you further in a hole, then it’s really not doing the homeowner a service,” Perry said. “We actually need grants of that sort. Not loans based on interest rates where we don’t necessarily know the proper assessment.”

Accurate appraisals are critical for PACE programs because lenders rely on home equity to screen applicants more than credit scores or income. Steve Sharpe, a staff attorney with the National Consumer Law Center who has studied PACE lending, said equity isn’t always a reliable indicator of whether borrowers can pay back a loan.

“Ability to repay has to be about whether a person with a set level of income can afford this particular loan,” he said.

For more affluent borrowers, PACE has been a fast, convenient source of financing for energy-related home improvements. High property values tend to give those borrowers more financial flexibility to manage the loans. Consequently, the resulting debt is less of a burden.

Jason Osborn used PACE when the air conditioning system in his 2,500-square-foot house died in the summer of 2018. He saw that the program promised fast installation and required no money down, so he took out a loan for about $10,300 from Renovate America, which was making the loans for MCED, though its interest rate was higher than other options. He intended to keep his costs low by paying off the loan quickly.

“I knew I wasn’t going to hold this loan for the duration,” said Osborn, who owns a truck and crane company.

Last year, Osborn sold his house in the prosperous, majority-white Kansas City suburb of Lee’s Summit for $325,000 and paid off the PACE loan. In the end, the interest and fees he paid on the loan were a small fraction of the value of his home.

Piffins has almost no chance of settling her debt so easily. She could sell her house, but at its current market value she would have to use most of the money from the sale to pay off the loan. If she holds on to the property, she faces years of pricey payments. She could prepay part of the loan and shorten her term, but she’d need to come up with at least $2,500, as Ygrene and Renovate America require.

Ygrene and MCED both declined to comment on specific loans. Ygrene said in its statement that it does not discriminate in its pricing. MCED said it no longer had access to the valuations used by Renovate America but, like Ygrene, said the public appraisals used in ProPublica’s analysis were too low. Renovate America officials did not respond to requests for comment.

Julie Tracy didn’t like what she was hearing. The tax collector from Worth County, a rural county in northwest Missouri, was in the audience at the annual state tax collectors’ convention in 2016 when executives from the PACE industry made a presentation.

The lenders were gearing up to begin making residential loans after launching the program with a focus on commercial property. Since homeowner loans would be repaid through property tax bills, some county collectors worried that borrowers would fall behind and default. If that happened, the collectors would have to sell borrowers’ homes at public auctions.

Tracy told the PACE executives sitting on stage that day that she thought it was fundamentally wrong for private lenders to use the government to collect debts, according to video from the event.

“I don’t want to do your dirty work for you,” she told the executives.

Steve Holt, then the collector in Jasper County, in southwest Missouri, chimed in. He predicted that PACE loans in his rural county would make the number of delinquent tax accounts go “sky high.”

“I don’t think it’s right,” he said.

John Maslowski, then an executive with MCED’s lender, Renovate America, tried to put the tax collectors at ease. The delinquency rates on PACE loans were minuscule, he said: just four-tenths of 1% in California. And he tried to clear up what he said was a misconception about the program — that the collectors worked for the lenders.

“That is not true,” said Maslowski, who has since left the company. The loans, he said, “are being made on behalf of the Missouri Clean Energy District.”

He also addressed questions about interest rates; some of the collectors were concerned they’d be too high. Maslowski said they would be between roughly 6% and 9% and wouldn’t change.

What’s more, he said, consumer protections were “the cornerstone” of his company’s product. Another Renovate representative explained how the system hinged on the fact that people tend to pay their property taxes, so folding the loan payments into property tax bills improved the likelihood of repayment. Bonds built from bad loans wouldn’t make good investments, the representative said.

Instead of easing their concerns, the meeting left many tax collectors ready to fight. Michelle McBride, the tax collector from the state’s third most populous county, St. Charles County, returned home from the conference determined to lobby the county council to bar PACE from operating there.

McBride disagreed with Renovate’s characterization of PACE as a government program. Rather, she saw it as a group of businesspeople who had figured out how to profit from the government’s power to issue bonds and collect taxes.

“It's an appearance of a government entity,” she said in an interview. “In my opinion, it is only providing what, historically, a private industry would have done — basically, a loan company, which is not a government undertaking.”

But PACE wasn’t walking away. Renovate hired a lobbyist, Tom Dempsey, to persuade the St. Charles County Council to join MCED. Dempsey had resigned a year earlier as president pro tem of the Missouri Senate, and County Council members knew him well. With his involvement, the council enrolled in PACE that November.

Other tax collectors tried to keep PACE out of their counties. The Clay County collector, Lydia McEvoy, refused to collect PACE loans until the state appellate court in 2018 affirmed a ruling ordering her to do so. Larry Vincent, the Cole County collector, and Leah Betts, then the Greene County collector, helped persuade officials in their counties to drop their involvement in PACE. Other small counties followed suit.

Vincent said that before Cole County withdrew from MCED in 2017, he served as the county’s liaison to the board. He said he found that board members were reluctant to exercise any oversight.

“Once I got uninvolved with it,” he said, “I tried to stay as far away from it as I could.”

State law requires the boards that oversee PACE lending to approve loans only for people who can afford them and to ensure that the estimated energy savings from each project are at least equal to its cost. But board members said they rely on their lenders to make those determinations.

MCED said it approves about two thirds of its applicants; Ygrene did not provide its approval rate, but it said in a 2019 meeting with St. Louis County board members that it approved about half of its applicants, minutes show.

With little oversight, lenders and contractors have sometimes acted in ways that are not in the best interests of borrowers, and with few repercussions. Some borrowers said in interviews that they didn’t understand what they were signing or didn’t grasp how the loans would affect their property taxes, but signed anyway.

And while some borrowers said they saw energy savings as a result of the work, others did not.

The districts and their lenders said they screen contractors to ensure they’re qualified. They say they only pay a contractor after the borrower has signed off on the completion of the work, and provide clear information up front about payment terms. They measure energy savings by the efficiency of the improvement, not what the borrower pays for the work, and said it’s up to the borrower to negotiate a price with the contractor.

But in St. Louis, an elderly widow said she had no idea she had taken on thousands of dollars in PACE debt, though she saw her property taxes rise sharply. A disabled couple in the Kansas City suburb of Raytown said they weren’t told of the impact on their property taxes; now they’re two years behind on their property taxes.

A Vietnam veteran and his wife in Kansas City are struggling to pay off a $21,658 loan for a solar panel array despite being enrolled in an energy assistance program; they said they just wanted to do something good for the environment.

In perhaps one of the most financially extreme cases, a PACE borrower in St. Louis County agreed to pay more than six times the value of his home to finance the purchase of a furnace through Ygrene.

Wasim Aziz’s 730-square-foot bungalow in the St. Louis County municipality of Wellston had no connection to gas, electricity or water and was in desperate need of other repairs. Zimmerman, the county assessor, recently described it as being in unsound condition, meaning it’s “practically unfit for use,” according to the assessor’s handbook. Its appraised value at the time was $3,900.

In early 2019, Aziz, a 63-year-old semi-retired union bricklayer, attended a fair organized by a local political leader for people interested in buying and renovating vacant properties. The goal was to connect them with contractors and lenders that came with a government stamp of approval.

Aziz, who acquired his house from a family member after spending time in prison on drug and theft convictions, wanted to fix it up. He grabbed a contractor’s flyer saying financing was available from Ygrene and called the number. When a contractor showed up at his house, Aziz said, he gave Aziz a form to sign to start the job. The contractor hauled in a furnace and connected it to the house’s ductwork.

Aziz assumed, perhaps mistakenly, that the contractor would help him get utility service restored to the house so the furnace would work. The contractor didn’t and, two years later, Aziz continues to live in a house without utilities.

“Nothing is connected,” Aziz said. “I can’t use electric. I can’t use nothing. I don’t even have a thermostat in the house.”

The project cost $9,385. If Aziz makes every payment on his loan, he will pay almost $25,000 for the project over 20 years. He is two years behind on his taxes.

Holtzman, the county PACE board chairman who signed off on Aziz’s loan, said he and the other two volunteer board members don’t ask many questions of Ygrene. He does not keep track of delinquency rates in the county but was not surprised that they were so high, particularly in the county’s majority-Black 1st Council District, which includes Wellston.

“It’s not my responsibility to go hunt down that information,” he said.

Sadowski, the MCED chair, said his board also did not get involved with specific projects, allowing Renovate America to handle every aspect of the loans. He acknowledged that the company, which is no longer the district’s lender, sometimes did a poor job. Renovate America officials did not respond to a request for comment.

Sadowski said he did not know that the law requires that homeowners save as much in energy costs over the life of the loan as what they spent on the project. He said the program is upfront about interest rates.

“Apparently,” he said, borrowers “thought it was a good deal to do this.”

The official whose job it is to sell tax delinquent property in St. Louis is the city’s sheriff, Vernon Betts. A lifelong city resident, he has seen the value of homes plummet since he grew up in the O’Fallon neighborhood.

On some blocks, many homes have been abandoned. Even more have been demolished. That leaves property owners with a tough choice: either walk away or stick with a difficult investment.

“When the houses are falling down,” Betts said, “it’s going to cost you more to keep them up then it would to just let them go.”

A few blocks from where Betts grew up, one homeowner has decided to invest in her property. She is using a PACE loan, which has meant committing to pay many times what her home is worth.

V Esther Boose, 78, borrowed nearly $31,000 for a new roof, windows and siding on a home she bought in 1985 with her late husband. Though she has used it as a rental property, it’s now vacant. By the time Boose repays the loan, she’ll be 96. And on top of the cost of the work itself, Boose will have paid about $46,000 in interest and fees, more than 12 times the value of the house when she took out the loan.

Even after those repairs, the house still needs work. Squirrels come and go through the rotted soffits. The foundation has a crack, there’s no furnace and the pipe fittings have been stolen. The kitchen floor sags.

She was late with part of her first PACE payment, in 2019, but paid on time last year.

“The Lord has gifted me with the ability to come up with the payment at the end of every year,” she said. “I’m doing the best I can.”

Betts questioned whether PACE was helping the neighborhood.

“Now she's in more debt,” Betts said, “and if she does continue to get deeper and deeper in debt messing around with this house, what do we do?”

ProPublica data reporter Irena Hwang reviewed the code and analysis.

Illustrated section breaks by Dawline-Jane Oni-Eseleh for ProPublica.