Update, Nov. 8, 2023: On Nov. 7, Midland school district voters approved a $1.4 billion bond proposal by a 56% to 44% vote, rejecting arguments against the measure from a nonprofit led by associates of billionaire oilman Tim Dunn.

Allies of influential Texas billionaire Tim Dunn are pushing ahead in Austin with efforts to create a private-school voucher system that could weaken public schools across the state. Meanwhile, Dunn’s associates in his hometown of Midland are working to defeat a local school bond proposal that his district says it desperately needs.

Dunn, an evangelical Christian, is best known for a mostly successful two-decade effort to push the Texas GOP ever further to the right. His political action committees have spent millions to elect pro-voucher candidates and derail Republicans who oppose them. Defend Texas Liberty, the influential PAC he funds with other West Texas oil barons, has come under fire after The Texas Tribune revealed that the PAC’s president had hosted infamous white supremacist Nick Fuentes for an October meeting and that the organization has connections to other white nationalists.

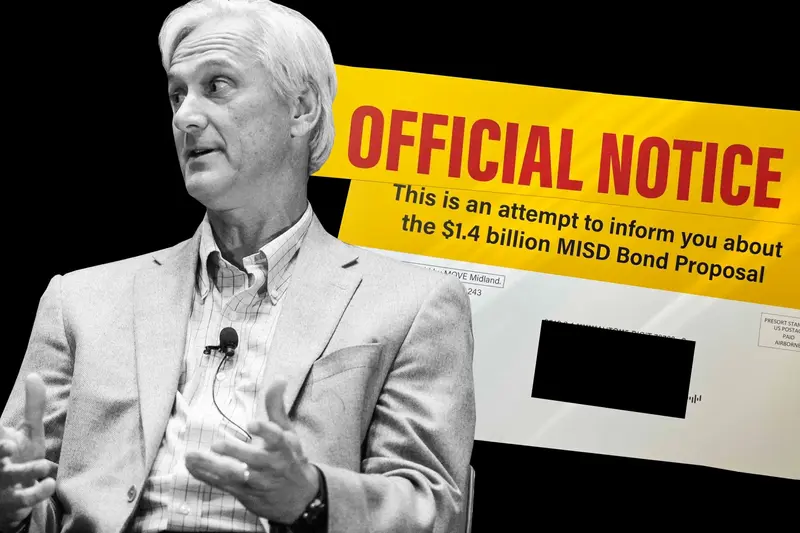

Less known are Dunn’s efforts to shape politics in his hometown of Midland, which will come to a head next week. On Tuesday, residents in the Midland Independent School District will vote on a $1.4 billion bond, the largest in its history, after rejecting a smaller measure four years ago. A dark-money organization whose leaders have ties to Dunn’s Midland oil and gas company, as well as to a prominent conservative public policy organization where Dunn serves as vice chairman, have become among the loudest voices against the bond.

On Sept. 21, less than two months before the Midland bond election, three Midland residents with deep connections to Dunn and his associated public policy organization registered a “social welfare” nonprofit called Move Midland.

The nonprofit is headed by Rachel Walker, a public affairs manager for Dunn’s oil and gas company, CrownQuest Operating LLC, according to public records. A second member, Ernest Angelo, is a former Midland mayor and board member of the Texas Public Policy Foundation, a conservative think tank that Dunn has helped lead for more than two decades. The third member of the nonprofit’s board is Elizabeth Moore, a former West Texas development officer for the Texas Public Policy Foundation.

Within weeks, the nascent nonprofit had a website, campaign signs and a social media presence as its directors appeared on local radio shows and in community debates to oppose the bond. In the local newspaper, another former mayor urged residents to visit Move Midland’s website for insights about the election. That former mayor, Mike Canon, had run for the Texas Senate in 2018 to unseat Kel Seliger, a prominent Republican who opposed vouchers. Another PAC funded by Dunn, Empower Texans, provided the bulk of his war chest, nearly $350,000, in a losing effort.

Move Midland and its directors have not called attention to their relationship to Dunn and his entities in public appearances. Biographies of the three directors on the nonprofit’s website make no mention of Dunn, CrownQuest or the Texas Public Policy Foundation, where Dunn serves as vice chair of the board.

Walker and other members of the group did not respond to voice messages, emails, Facebook messages or requests made through the Move Midland website.

Dunn likewise did not respond to specific questions regarding the Midland bond and the role of his various entities. Defend Texas Liberty has condemned Fuentes’ “incendiary” views and replaced its president, but has not provided any details about its association with the white nationalist. Dunn has reportedly called the PAC’s meeting with Fuentes a “serious blunder.”

During a debate hosted by the Midland Reporter-Telegram, Walker said that the group is “more than just me. There is a group of informed and involved Midlanders involved in this organization. And we have every right to speak on this issue, because we are taxpaying citizens, just as the rest of the involved and informed community does.”

Walker has said that the group would be open to a scaled-down version of the bond in the future, but that should come when “our taxpayers feel like they have trust in the system, and right now, they just have an overwhelming distrust of how MISD is spending their tax dollars,” she told Marfa Public Radio.

Because Move Midland was formed as a nonprofit and not a political action committee, it is not required to disclose the sources of its funding. Organizations that engage in campaign activity but don’t disclose where their money comes from are typically considered “dark money” entities. A small number of states, including New York and Connecticut, require disclosure of donors who contribute to 501(c)(4) nonprofits that engage in lobbying or make political contributions.

The IRS allows such nonprofits to shield the identities of donors as long as political activity doesn’t constitute the group’s primary activity, though it rarely takes action against nonprofits that violate its rules.

According to its website, Move Midland is “dedicated to making Midland better” and plans to tackle various community issues. The bond election represents the group’s “current area of focus.”

Bond supporters, including a large chunk of the Midland energy sector, say it is crucial to relieving overcrowding and modernizing outdated facilities.

Supporters also have raised questions about the timing of Move Midland’s creation and expressed frustration that its donors are shielded from public view, unlike funders of traditional PACs.

“It seems disingenuous and also unfair and very odd that you would not disclose who’s behind it when as a PAC, they would have to,” said Josh Ham, a volunteer with the pro-bond PAC Energize Midland Schools.

Texas Ethics Commission records show the Energize Midland PAC has received more than $530,000 in contributions, most of it coming from Midland energy companies, which hail the election as an opportunity to cultivate a more robust labor force.

That far outstrips the $10,252 raised by Midlanders for Excellence in Education, a local PAC that opposes the bond. According to campaign finance reports, Midlanders for Excellence in Education has used much of that money to pay for signs and radio advertising.

Walker, the Move Midland leader, reported spending $33,432 to oppose the bond, including payments for direct mailings, text messages and yard signs. Texas law requires nonprofits that engage in independent campaign activity to disclose campaign-related expenditures to the state, but like the federal government, it does not require such groups to disclose the source of their funding. It is unclear if Dunn has given money directly to the group.

Ham said that he does not know who is funding Move Midland, but that its sudden appearance after two years of bond planning makes him question the motivation behind the effort. “To have someone just come along overnight and pop up with just a couple of talking points and with no real support is disappointing,” he said.

Dunn has not been quiet about his concerns over the bond. In an Oct. 15 commentary in the Midland Reporter-Telegram, Dunn accused bond supporters of not being forthcoming with voters about the bond’s tax impact. The district says the bond won’t raise tax rates because the new rates adopted in September were set lower than the previous year’s and included the bond’s impact. Dunn argued that the bond will soak up the $18 million in statewide property tax relief recently approved by the Legislature and that tax rates would be even lower if not for the bond.

While Dunn’s oil companies operate in multiple states, they control mineral properties that, combined, owed more than $1.3 million in estimated property taxes to the school district for 2023.

Dunn called claims that the bond won’t result in a tax rate increase “somewhere between materially misleading and factually false.”

In fact, Dunn noted, the actual ballot language Midlanders will find when they go to the polls will include the clause, “This is a property tax increase.”

Public policy organizations connected with Dunn played a central role in ensuring that the phrase is attached to every single school bond ballot measure in the state, regardless of the bond measure’s actual impact on local taxes.

The phrase, tucked into a 308-page bill in 2019, didn’t make headlines at the time, but those six words have since had an outsize impact on school bond passage rates. According to Dax Gonzalez, director of governmental relations at the Texas Association of School Boards, the phrase is at least partly responsible for the decline in school bond passage rates in subsequent years.

From 2000 to May 2019, about 75% of all school bond proposals passed, according to data from the state’s Bond Review Board. That passage rate has dipped to 64% since November 2019, which bond supporters have attributed to the new ballot language and pandemic-related worries. In elections this past May, that number rebounded to 78%.

“I really do believe that the sole purpose of that language is to decrease the amount of bonds that pass,” said Gonzalez.

Earlier this year, Dunn-backed entities marshaled opposition to attempts favored by public education supporters to give districts more flexibility in the required ballot language in cases where bonds don’t result in tax rate increases. None of the bills made it out of committee.

Dunn has weighed in on local Midland politics before. In 2019, Dunn cast doubts on the Midland school district’s $569 million bond proposal in an op-ed in the local newspaper in which he wondered whether school district officials were “sufficiently committed” to improving the quality of students’ education.

Although officials initially announced the bond had passed on election night, the bond proposal ultimately lost by 26 votes after Midland County election workers discovered a box of unopened ballots weeks after the election.

A few months later, Dunn threw his support behind a sales tax increase for the Midland County Hospital District, explaining in a newspaper column that “high property taxes violate a founding principle of America: private property ownership.”

Sales taxes, Dunn argued, “are the only broad-based, transparent and optional forms of taxation.”

The sales tax increase passed handily in July 2020.

A shift from property taxes to sales taxes at the state level has long been a goal of the various public policy organizations associated with Dunn. According to Texas Comptroller estimates analyzed by the Tribune, sales tax increases cost poor Texans more than wealthier ones, making it a regressive tax.

For some bond supporters, Dunn’s opposition to the current bond proposal is a reflection of his embrace of vouchers for private schools.

“Having a vested interest in a private school, while politically funding an agenda that includes private school vouchers, appears to present a pretty clear conflict of interest for Tim Dunn,” said Reagan Hignojos, a former Midland school board candidate and bond supporter. “These private schools would not be held accountable or be transparent by the same standards of public schools.”

Dunn is the founder of Midland Classical Academy, a private school that offers its approximately 600 K-12 students a “Classical Education from a Biblical Worldview,” according to its website. The school explains that through this lens, “human civilization is rightly understood to have begun in the garden with Adam and Eve.” The school believes in interpreting the Bible in its literal sense, which it takes to mean that marriage can only be between a man and woman and that there are only two genders.

Dunn’s school is currently unaccredited, however, according to data provided by the Texas Private School Accreditation Commission. Under legislation proposed by Texas lawmakers, including several state senators who have received campaign funding from Dunn and his associated PACs, private schools would need accreditation to be eligible for taxpayer dollars.

Dunn has not weighed in on whether his school would pursue voucher payments, and in 2014 he explained the lack of accreditation, writing that the requirements “deal mainly with processes and credentials rather than focusing on an excellent academic and student life opportunity.”

The school did not respond to questions about any potential accreditation or voucher plans.

According to its 2021 IRS filing, the most recent available, the school had $10.4 million in total assets and revenue of $6.3 million, a 66% percent increase compared to what it earned in 2020.

Dunn and his family own five million-dollar homes on land adjacent to Midland Classical Academy, where property taxes go to Midland ISD.